The Community Round - equity crowdfunding to hack superfans, distribution, & growth 🤝

the most important missing piece of your growth plan

It absolutely blows my mind that launching a Community Round isn’t a core piece of the fundraising playbook for 90% of the startups out there.

Imagine bringing on 100 to 1,000 investors who are bought in to what you are building.

They are likely early adopters of your product

They are now willing to support you by recommending users, employees, and other investors

They are available to provide product feedback, act as advisors & mentors

Community Rounds work by allowing your superfans to turn into investors with as little as a $100 investment, all within a single Special Purpose Vehicle which means there is only one line on your cap table.

While you normally need to be an accredited investor, anyone can invest into a Community Round up to a maximum of $2,200.

Startups give their employees equity because it helps align incentives & drives increased performance + commitment.

The exact same thing happens when you give your users equity.

Even if it is $100, it gives your users the chance to say “I own a piece of this product that I absolutely love.” This drives increased usage. This drives increased word of mouth referrals. This creates a deeper moat within your most loyal fans.

Here’s everything you need to know about the most important piece of your growth strategy, that you’re likely missing.

What are some good examples of companies that have raised a Community Round?

Breaking a WeFunder record, Mercury (probably the absolute best startup bank) raised $5,000,000 from 2,450 investors … within literally 90 minutes.

75% of them were already customers, and within 9 days they reached over $23,000,000 in reservations.

Why did they raise a Community Round?

"It's aligned with our mission and brand to give customers ownership and be part of our success. Most of our growth is word of mouth. We felt that ownership would supercharge that." - Immad Akhund, CEO @ Mercury

Mercury had already raised over $120M with their Series B, the key reason they went forward with their Community Round wasn’t to raise more funds but to supercharge their word of mouth growth.

Again, after raising their Series B, Replit (an online programming environment) launched their Community Round by announcing it at their very first annual conference.

Their goal was to allow their most engaged superfans to have first shot at the allocation. They ended up raising millions within an hour, and a total of $5,439,225 from 2,647 investors.

Why did they raise a Community Round?

"Users are waking up to the fact that they should be part of the upside. It's clear to me that the future of the internet lies in community ownership. And any startup that wants to align their incentives with that of their users should consider a community round!" - Amjad Masad, CEO @ Replit

Other major Community Rounds include:

Levels raising $5M from 1.4k investors

Synthesis raising $3M from 1k investors

Substack raising $7.8M from 6.7k investors (my personal favorite 😍)

Immersed raising $9M from 3.3k investors

Wefunder themselves raising $19.4M from 6.6k investors

Who should (and shouldn’t) raise a Community Round?

The primary reason you should be raising a Community Round isn’t actually to raise funds, but to allow your most passionate followers to become owners in your company … at really excellent terms.

This should be at the core of your strategy.

This means that the best time to raise the round is when you have a product that is already built, and superfans who love the product.

Mercury raising as a random bank that no one had ever heard of, likely wouldn’t have preformed as well. The hardest time to raise a Community Round is when you don’t already have users or at least “some” kind of community base.

When you raise the round, in addition to launching to your own community, you will gain distribution by getting placement on the Wefunder platform.

The products that receive the most rewards from this distribution are usually consumer focused or have a really broad appeal. If you’re an obscure B2B enterprise tool, this likely wont be super helpful.

This distribution was extremely impactful for Levels because everyone (who is into the wellness space) could use their Continuous Glucose Monitor.

Food & beverage, consumables, gaming startups, other marketplace startups, consumer focused DNA tests - these have all done pretty well.

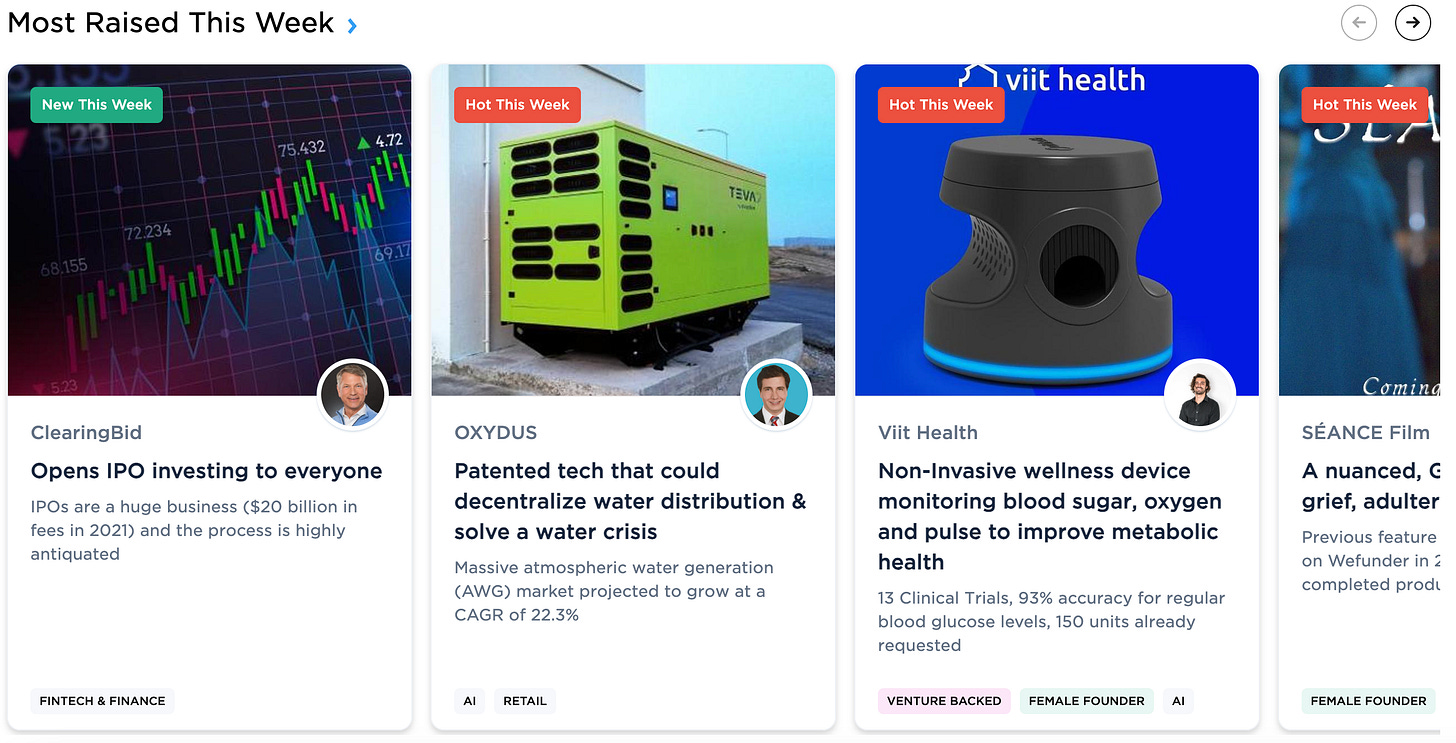

Looking at what’s done best this week right now, it’s “another” platform for consumers to invest, cleantech, and a home glucose device.

The basic Community Round playbook

If you want to raise a Community Round start by setting up an account on Wefunder. They are by far the market leader in equity crowdfunding & you have the biggest chance of success on their platform.

Your basic playbook is going to look like this:

Build out your Wefunder profile with images, video, and the story behind your fundraise / traction

Launch privately to your email list, social media, and directly to your current superfans

Launch publicly on the Wefunder platform, gain enough traction (ideally from your private launch) to become featured as a top startup on the “most raised” section

Having a VC or notable angel lead the round will also help you maximize your distribution on the Wefunder platform. Not only is it the #1 section of startups that Wefunder will promote, but it helps create social proof to the rest of the investors that “someone” has vetted the startup.

After the Community Round is finished, make sure to follow up with swag, gifts, and asking your new investors for things that will help push the company forwards!

This can be directly asking for user referrals, promoting new hires, and engaging with you on social.

Execute it well and you now have an army of superfans who are literally bought in to your companies success & will be extremely happy to help promote you. Your success is their success, and you are all in the wild ride together.

PS - if you want help launching your Community Round just LMK 🙏 if you can’t tell I’m a pretty huge fan of Wefunder (30+ investments) & would love the opportunity to invest in some of my followers. 🔥

Want to keep reading?